0 deductible health insurance reddit

All 0 deductible means is your insurance starts helping out from the start. Here is an example.

Bright Health Insurance Review Who Should Sign Up Valuepenguin

You cant be claimed as a dependent on someone elses 2019 tax return.

. Zero-deductible plans typically come with higher premiums whereas high-deductible plans come with lower monthly premiums. You would have to contact your insurance to find out about copays and coinsurance. Bronze 0 Medical Deductible Coverage for.

You have no other health coverage except what is permitted under Other health coverage later. Reviewed by licensed agent Brandy Law. This saves them 721 a month or 8652 per year.

A no deductible health insurance refers to a policy where insurers dont have to pay a minimum amount before your insurance begins to pay for your healthcare expenses. If you dont have a lot of doctor visit go with Premera high deductible plan. The cost for a 6000 deductible plan from Aetna is 654 per month.

1500 deductible max out of pocket 2500 for single. Ad Health Insurance For 2022. If you have a mild health condition and you only go to a doctor a handful of times a year a 2k deductible is no big deal.

0 deductible just means there is no deductible to satisfy before benefits kick in. Updated Nov 22 2021. An insurance plan with no deductible may appeal to consumers who frequently visit.

The coinsurance on a medical plan is what the insurer pays after the deductible is met. Browse Personalized Plans Enroll Today Save 60. 6650 Out of pocket maximum.

Or will the hospital refuse treatment because the insurance company only pays for part of the treatment minus deductible and being adamant the patient pays the deductible part directly to the hospital first. No-deductible health insurance policies are health care plans with a deductible of zero that allow coinsurance and copay benefits to begin immediately. You arent enrolled in Medicare.

Instantly See Prices Plans and Eligibility. In the case of my insurance I have to pay 20 of the cost before I reach my Out of Pocket Maximum. The deductible is the base amount you must pay during a given time period for example yearly before your insurance carrier is going to step in.

Reasonable deductible to premium ratio question - It depends on your needs. For basic health care services use on campus clinic for cheaper doctor visits and prescription. 0 Out of pocket maximum.

In other words you must pay up to an amount on the health expense before the insurer contributes. Your out of pocket max would come into play with copays most likely. Coinsurance is the portion of your medical bill that you are responsible to pay before or after a deductible is met.

Health insurance as with any other type of insurance can sometimes be difficult to understand. If it has a coinsurance you get a percentage covered by the company and then you owe the other percentage ex. Lets say you need a 15000 procedure.

First thing that happens is that your insurance company determines how long the race is gonna be. If I foresee that I need a lot of medical care then I would go with the 0 deductible plan which costs more. Yes a zero-deductible plan means that you do not have to meet a minimum balance before the health insurance company will contribute to your health care expenses.

These plans may be a good fit if you are expecting high medical expenses during the policy year. And Im gonna toss in some other health insurance terms for good measure. Will the insurance company pay the hospital first and then later chase the insured customer to pay the deductible.

See How Aflac Supplemental Insurance Can Help You With Out-of-Pocket Expenses. If they take 6000 of the savings and place it into their health savings account they start out 2652 ahead. Premera has bigger network and covers more drugs.

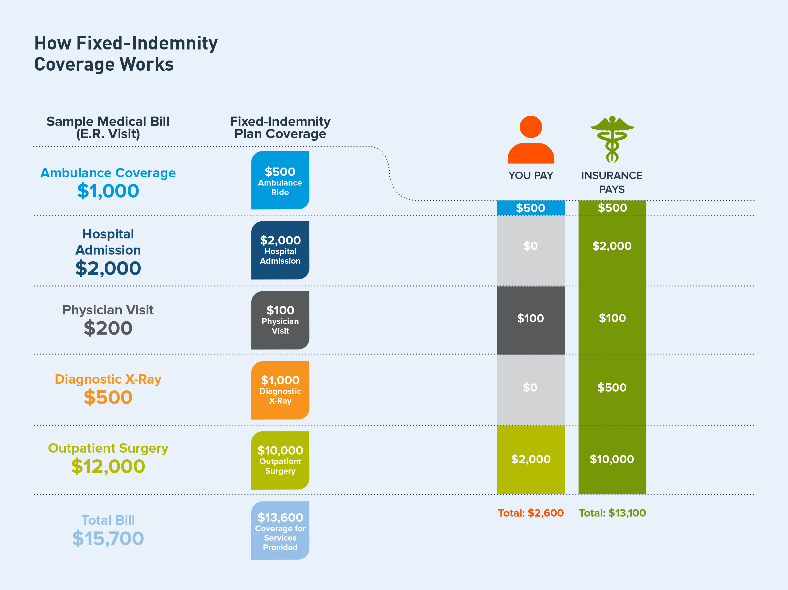

So in your case with a 0 deductible the insurer will pick up 100 of the cost from the first dollar. If its a fixed indemnity you get a fixed benefit towards every claim. Our other option is a plan with a 2300 PP deductible and a 7900 PP OOP max OOP max is the same for both plans.

Ad Aflac Offers a Wide Range of Policies to Help You Feel Confident about Your Coverage. Oscar Insurance Company of Florida Monthly premium. You are covered under a high deductible health plan HDHP described later on the first day of the month.

For the first time we have the option of a zero deductible plan that is almost entirely co-pay based. They will in effect have 0 deductible health insurance even if they spend all of the money in their saving account each year. Obamacare Coverage from 30Month.

Some examples of the co-pays. Florida Blue Blue Cross Blue Shield Monthly premium. Such policies are also called zero-deductible health plans.

The SBC shows you how you and the plan would share the. Microsoft puts 1000 to your HSA every year. 50 Coinsurance after deductible.

If your deductible is 100 and the dentist checkup was 300 then you must pay for the first 100 of the 300 leaving 200 for insurance. People who do not have children are recommended to pay for insurance with higher deductibles. Individual Family Plan Type.

Visualize the paying of this procedure as a hurdle race. 40 Coinsurance after deductible Out of Network. From copays to out-of-pocket maximums no two plans are the same.

When You Should Consider A Zero Deductible Plan. 2000 Out of Pocket Max. Just be careful with an HMO and make sure all doctors are in network.

Because a no deductible health insurance plan can cost almost twice as much per month they are recommended for people who do not expect to need medical care in the near future. Drs visit 15 Diagnostic test 100 ER visit 500 Imaging 500 Hospital stay 250day. EPO The Summary of Benefits and Coverage SBC document will help you choose a health plan.

Open Enrollment 2022 Guide Healthinsurance Org

Dangers Of Fixed Indemnity Plans But Not In The Eyes Of The Court Triage Cancer Finances Work Insurance

How The Earned Income Tax Credit Could Get You More Money Money Management Activities Tax Credits Personal Finance Budget

Ready To Start Fixing Your Finances And Have A Better Future You Ll Need To Build Your Own Personal Financial Plan L Financial Planning How To Plan Financial

Stride Oscar Prop 22 Health Insurance Stipend Explained

Oscar Health Insurance Review Great Benefits In 8 States Valuepenguin

Dangers Of Fixed Indemnity Plans But Not In The Eyes Of The Court Triage Cancer Finances Work Insurance

![]()

Am I Understanding American Health Insurance Right R Insurance

Average Health Insurance Cost For Married Couples Lively

Irdai Proposes To Restrict Proportionate Deduction In Health Insurance Claims To Help Policyholders The Economic Times

Bright Health Insurance Review Who Should Sign Up Valuepenguin

Businesses Manage Medical Bill Payment Plans Http Www Nytimes Com 2013 09 19 Your Money Businesses Medical Billing Healthcare Costs Free Health Insurance

Oscar Health Insurance Review Great Benefits In 8 States Valuepenguin

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Bright Health Insurance Review Who Should Sign Up Valuepenguin

Insurance Health Services The University Of Texas At Arlington

Comparing Health Plan Types Kaiser Permanente Health Plan How To Plan Health Insurance Plans

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)